What’s the problem with Company Voluntary Arrangements (CVAs)?

A Company Voluntary Arrangement is a business debt management tool in the UK that allows an insolvent company (a company that is unable to pay its bills when they fall due) to write off some of its debts, reorganise its internal structure and repay its debts over an agreed fixed period.

In theory, a CVA should help a struggling business to reduce its monthly expenditure (and therefore ease the immediate pressure on it) and increase the likelihood of long-term survival.

Unfortunately, a huge proportion of companies that attempt a CVA end up collapsing.

A 2006 study analysed 177 CVAs in Scotland, charting the outcome of each individual case. Astonishingly, just 14% of companies in the sample remained active with a further 13% of CVAs still to conclude. A terrifying 31% ended with insolvent dissolution and 18% were dissolved without further procedure.

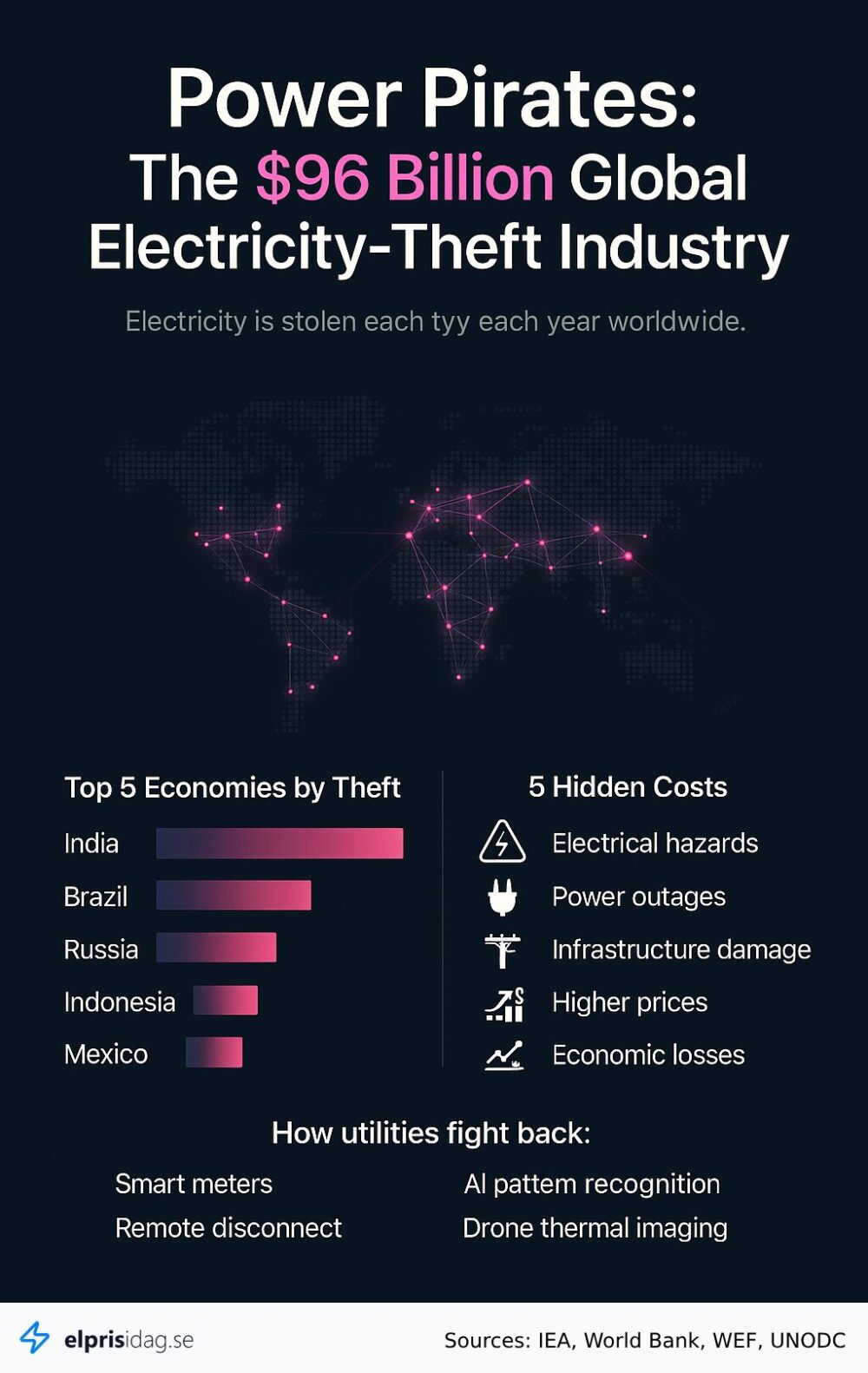

Infographic from 180 Advisory Solutions.

![]()

![5 Mind-Blowing Multi-Million Dollar Startup Business Ideas [INFOGRAPHIC] 5 Mind-Blowing Multi-Million Dollar Startup Business Ideas [INFOGRAPHIC]](https://i2.wp.com/www.ucollectinfographics.info/wp-content/uploads/2025/10/NUCLEAR-INFOGRAPHIC-2024-logo-375x1924.jpg?w=100&resize=100,80&ssl=1)

![9 Surprising Stats About Entrepreneurs That Will Inspire You [INFOGRAPHIC] 9 Surprising Stats About Entrepreneurs That Will Inspire You [INFOGRAPHIC]](https://i2.wp.com/www.ucollectinfographics.info/wp-content/uploads/2025/10/interesting-stats-about-entrepreneurs_524c41624cd8f-670x1924.jpg?w=100&resize=100,80&ssl=1)